You’re unlikely to be profitable at exit

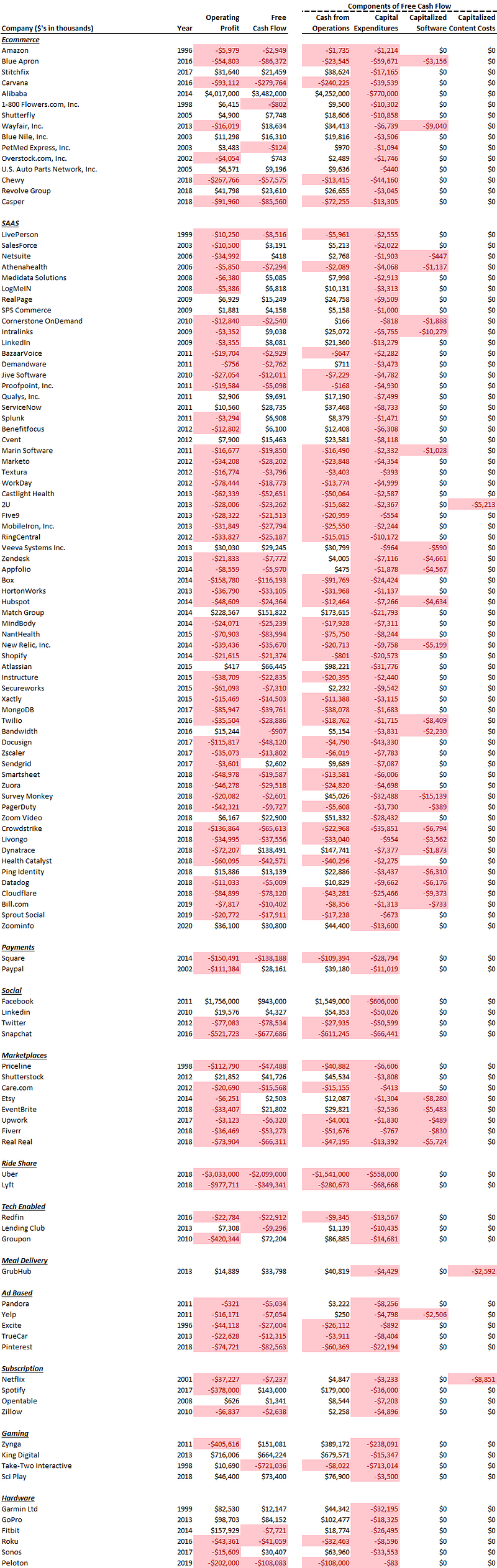

Venture backed companies like Airbnb, Uber, WeWork, and Spotify, are unprofitable. Is this the norm or just a trend for the more recent vintage of high flying companies? To answer that question, we took a look at the operating income and free cash flow of 123 tech companies at the time they went public going as far back as 1996 (Amazon). The data shows that profitability at exit depends on the type of tech company you are.

Ecommerce on median generates a profit. The median operating income and free cash flow at the time of exit was $3.4mm and $743mm respectively. This makes sense: because ecommerce revenues are less predictable and not contracted recurring revenue, these businesses generally need to be profitable, especially on a transaction level.

SaaS is highly unprofitable. With median operating income and free cash flow of -$20mm and -$8mm, SaaS businesses can get away with unprofitability at the time of exit because their revenue is contracted and recurring. In fact, 53 out of the 65 companies listed were unprofitable and 44 didn’t generate positive free cash flow. Because investors love the recurring revenue model, so long as you’re growing cash efficiently, you can get away with unprofitability as a SaaS business.

Social media is a mixed bag. Facebook and Linkedin which are bellwether social media properties were profitable at the time of exit, while Twitter and Snapchat were not. Twitter and Snapchat had fantastic growth at the time of IPO though, hence they had successful IPO’s. Fast growth can overcome burn, within reason.

The real burners. Marketplaces, ride share, tech enabled services, and ad based, light money on fire. Almost note were profitable at the time of IPO except Shutterstock and Lending Club.

Hardware and gaming. The gaming companies were all profitable but one (Zynga) and hardware companies generate operating income or free cash flow half of the time.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . Connect on LI as well. We like to lead or follow. We invest $1mm in growth rounds, inside rounds, small rounds, ‘tweeners’, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.