Revenue multiples in consumer tech

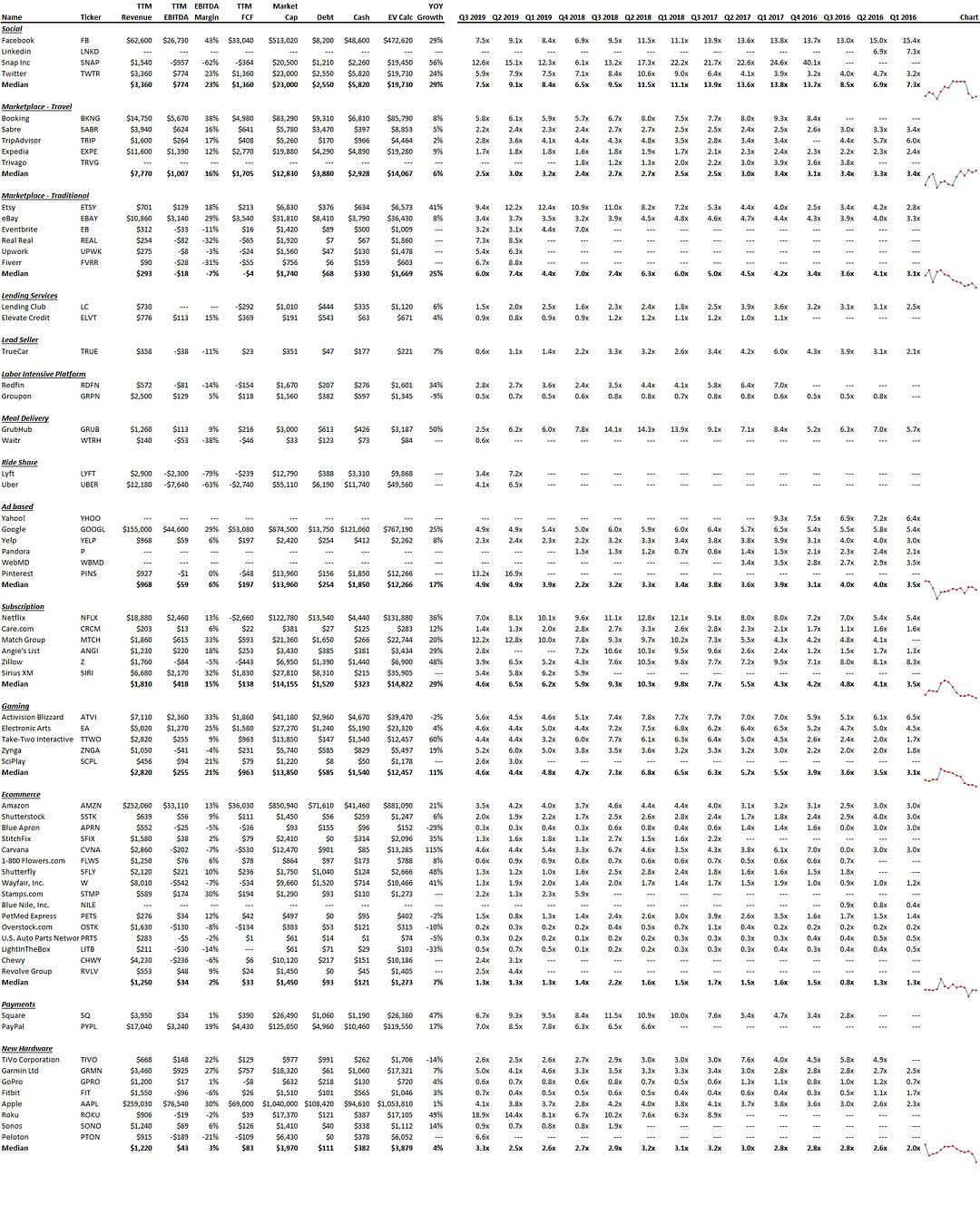

Below are revenue multiples for publicly traded consumer tech companies we follow (B2C). Industries vary widely. Commentary is below.

Social media is settled around ~8x. The median revenue multiple is now 7.5x and the last 4 quarters are averaging 7.9x. While the revenue multiple is still strong, it’s down from a highs of ~14x in 2017. Snapchat has settled in at 12x to 13x for the past 3 quarters, after falling from 40x in Q4 2016.

Travel marketplaces are steady. This sector has traded in a tight range of 2.4x to 3.4x since we began collecting the data, with the latest revenue multiple coming in at 2.5x.

Traditional marketplace multiples vary widely. Prior to Q3 2018, the sector only had 2 companies and now has 6, so it’s been a busy space. Last quarter the median multiple was 6x, but note the range is very wide, from 3.2x (Eventbrite) to 9.4x (Etsy).

Subscription. Subscription has been humbled since 2018, and now trades at 4.6x revenue. Netflix and Match’s revenue multiple continue to be the outperformers at 7.0x and 12.2x respectively, because their customers are so sticky.

Gaming. The median revenue multiple of 4.6x is strong. SciPlay, the latest IPO in the space, is an extreme underperformer at 2.6x. Excluding that outlier, the remaining peers trade at 5.0x on average.

Ecommerce is soft. The sector is the least attractive to investors, with a median revenue multiple of 1.3x. There is a big difference between what we would call premium ecommerce like Carvana and Amazon (4.6x and 3.5x), versus weak ecommerce like Blue Apron (0.3x revenue).

Hardware is consistent. Hardware is steady at 3.3x, and has traded in a tight range historically of 2.0x to 3.3x. Roku is the standout of the group (18.9x) followed by Garmin (5.0x) and now Peloton (6.6x).

Visit us at blossomstreetventures.com or email us directly with Series A or B opportunities at [email protected].