one time revenue matters in SaaS

Everyone loves recurring revenue and rightly so: it’s far more valuable than one-time revenue to VC and acquirers. But, don’t forsake one-time revenue. Whether it’s for services, onboarding, licensing, or some other one-time event, revenue of this type is incredibly valuable especially at early stages. There are three big reasons it’s valuable:

It’s a Source of Cash. The most obvious reason one-time revenue is valuable is that it’s a source of cash to fund overhead. Indeed while a VC or acquirer may not ascribe a multiple to that revenue stream, they’ll absolutely look at it as “financing” for the core business. While the business is still burning money, one-time revenue is as important as recurring revenue as a source of cash.

It Preserves Founder Equity. The less obvious reason one-time revenue is valuable is that it prevents a founder from having to raise more cash, and the less cash you raise, the more equity you preserve.

It Can Make You Sticky. Too many companies today focus on building products that are low/no touch. Their idea is to build a product that’s so good, the customer never has to call you for anything. On paper that sounds amazing but in practice, it’s not practical as the customer wants customer service, especially when ACV is $24k+. It’s about not just being a product, but a solution. Solutions include the product but also encompass a level of touch with the client, and companies that touch their clients often with consulting, services, or ancillary needs tend to have way less churn.

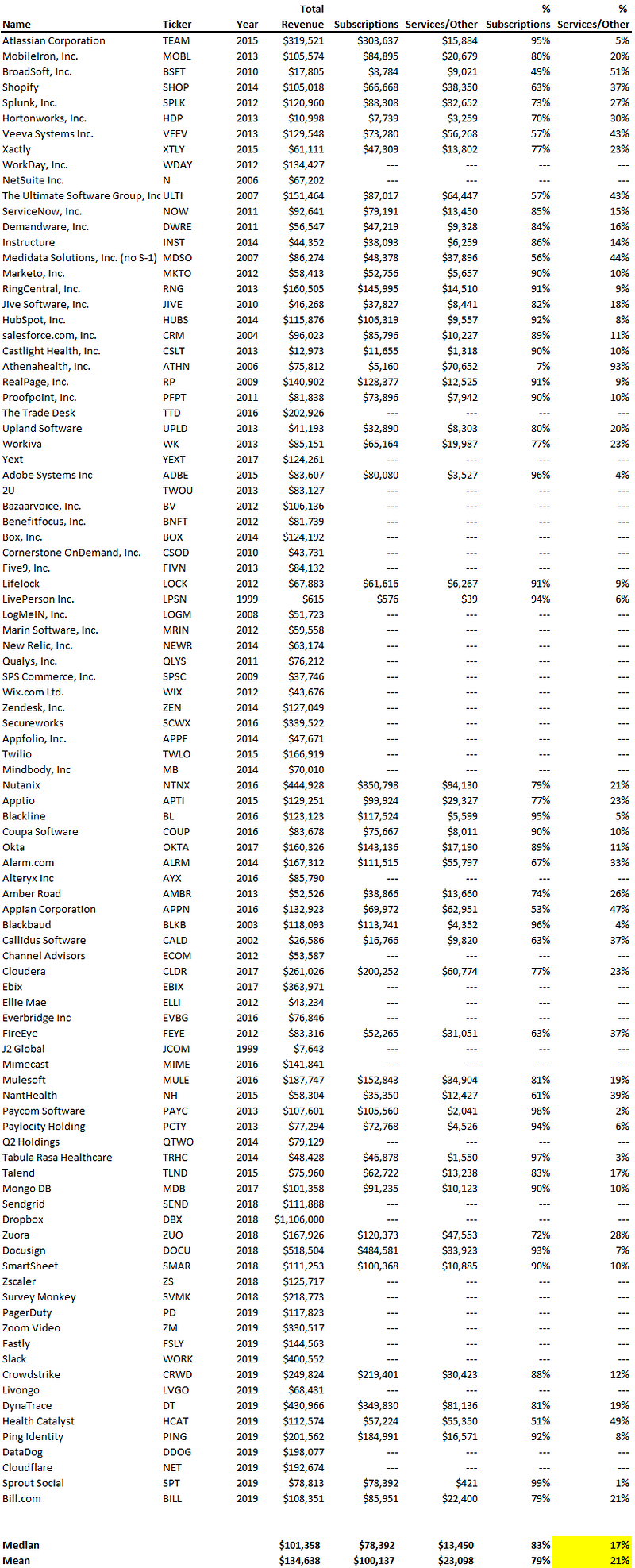

Indeed, some of the best SaaS businesses in the world generate a lot of services/one-time revenue as it’s a valuable source of cash and makes the product stickier. The list below shows that at the time they went public, the 95 SaaS companies below on median generated 17% of their revenue from non-SaaS sources and 21% on average. It’s material.

Even though it’s not as sexy as recurring revenue, don’t forsake onetime revenue. For the reasons above, it can be every bit as important as recurring revenue, especially while you’re burning cash.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . Connect on LI as well. We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.