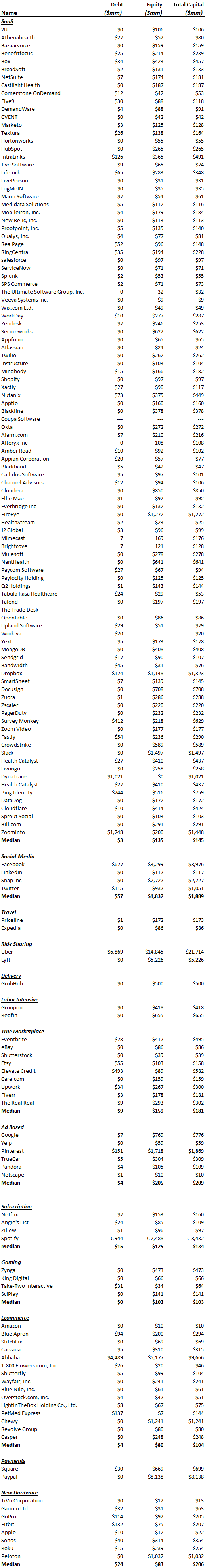

Capital raised prior to exit in tech

What’s the level of investment needed to build a tech company that goes public? The data and observations from 161 tech IPOs are below.

Software businesses needed $135mm of equity. On median, publicly traded software companies raised $135mm through their Series D before going public. Note the average equity raised of the 16 companies that IPO’d in 2019 and 2020 is much higher at $358mm. Building a software business is getting more expensive, they’re going deeper into private fundraising (Slack raised through a Series H), and newer software is taking on average 11 years to exit which is in line with the median of the entire data set (9 years). Software companies are not staying private longer, they’re just raising a lot more money before going public to get a lot bigger; the average revenue of the 2019/2020 IPO’s is $198mm versus a median of $106mm for all software companies.

Social Media raises the most. Social media companies on median didn’t exit until after their Series F and raised on median $1.8bln of equity. Linkedin was the baby of the group raising only $117mm of equity through the Series D before going public. Note Facebook and Snap took in $3.2bln and $2.7bln before going public.

Gaming and Ecommerce are efficient. Relative to other tech peers, these companies raised far less equity prior to going public: $103mm and $80mm respectively. The gaming sector raised only through the Series B while E-commerce went public after the Series C. The sectors IPO’d 6 to 8 years after founding. Even newer ecommerce businesses like Blue Apron and Stitch Fix took only 4 and 6 years respectively, although note Blue Apron went through $200mm of equity and $94mm of debt to get there. Casper went through $248mm of equity.

Hardware is a similar story. Hardware companies raised only $83mm of equity on median, exited after 11 years, and did so after the Series D. Roku and Sonos required 16 and 14 years to exit raising $239mm and $314mm, respectively. Peloton needed only 7 years, but plowed through $1bln.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.