Venture ownership at exit

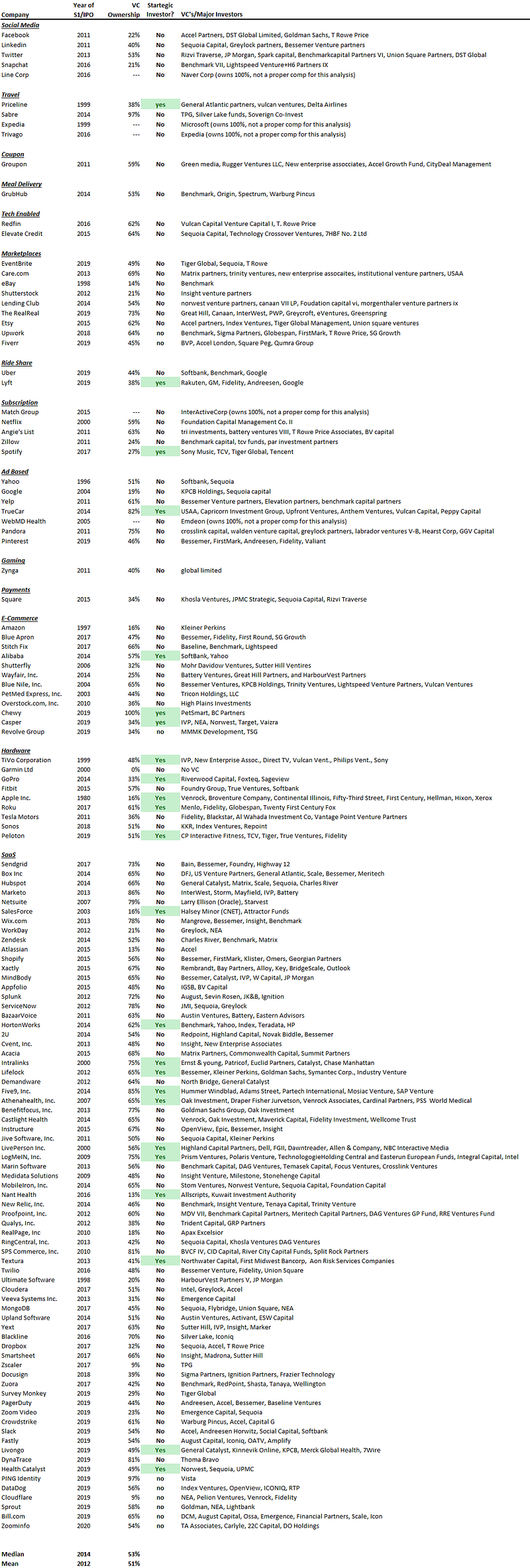

When tech companies exit by going public, how much of the company is owned by venture investors at that point? We looked at 131 tech IPO’s to find out. The data is below.

Our big take-aways are below.

Venture owns ~50%. Venture and other major investors own on median 51% and on average 53% of the businesses that exit by going public.

Some VC have the Midas Touch. A number of VC pop up repeatedly in different deals. For instance, Bessemer, Sequoia, Benchmark, Andreesen, Greylock, DST, and Accel are each in multiple deals. There is a reason funds like these can raise billions of dollars, and it’s because of the success of the entrepreneurs they invest in.

Strategics don’t matter. Of the 131 tech companies that have gone public, only 24 had a strategic investor. That’s only 18% or less than 1 in 5.

Founders owned 15%. Although we don’t show the data above (that’s a different blog), founders owned on median 15% and on average 20%.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.