Q2 SaaS M&A report

We recently got Software Equity Group’s SaaS M&A Snapshot for Q2 2020. SEG is an investment bank focused SaaS companies and they put out fantastic data on what they’re seeing in the market. They’re also a great firm if you’re looking for a banker (softwareequity.com or I can make an intro). Key observations from their latest report are as follows:

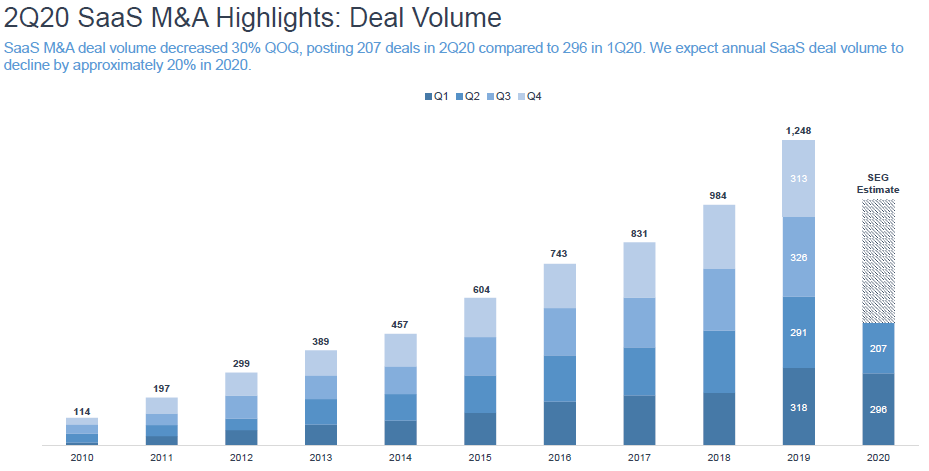

Deal volume cratered 30%. There were 207 SaaS deals done in Q2 2020 versus 291 in Q2 2019.

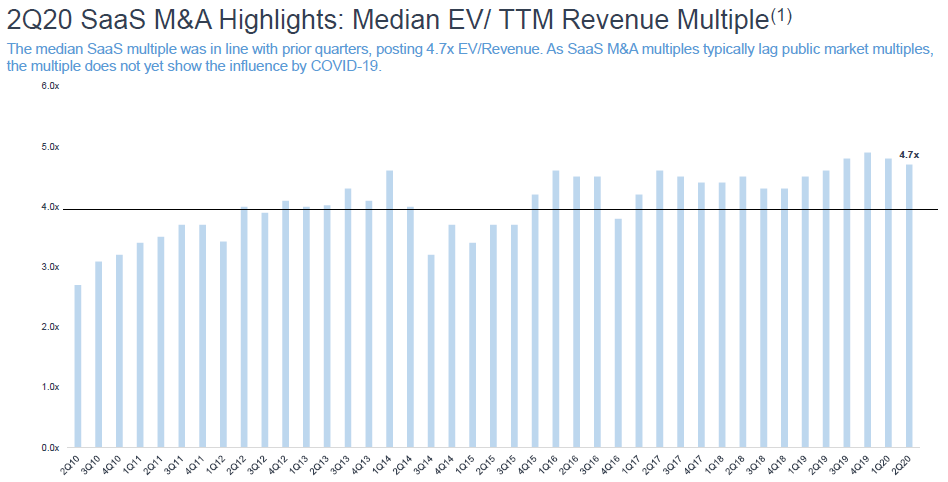

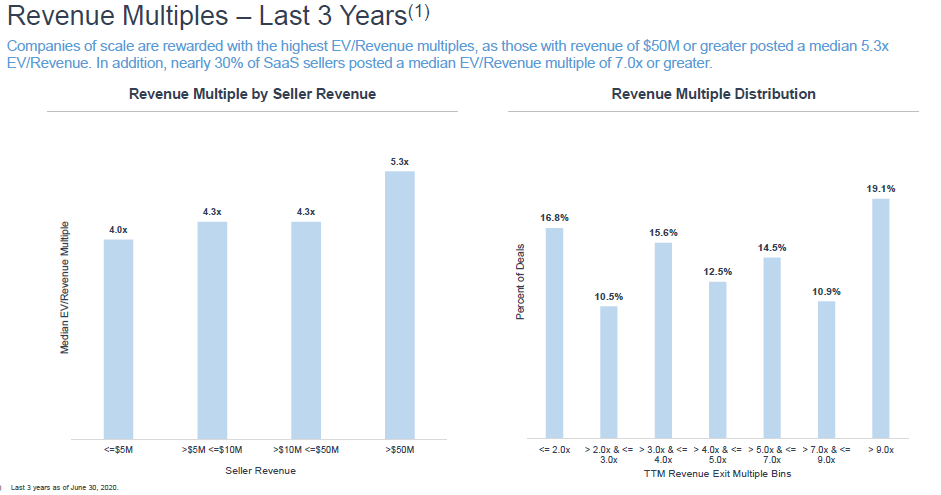

We haven’t yet seen an impact on multiples. The median revenue multiple was 4.7x in Q2, in line with recent trends. Since Q4 of 2015, the median has remained above 4x every quarter except one (Q4 2016 it dipped to 3.8x). In the last 3 years ended Q2 2020, ~47% of companies sold for greater than 5.0x trailing twelve months revenue and ~30% sold for 7x+.

Size drives multiples. Valuation is driven in part by company size. Organizations exhibiting scale are generally rewarded with higher multiples. Over the past 3 years, companies with revenue between $50mm to $100mm (trailing twelve months) posted the highest median multiple (5.3x EV/Revenue).

In M&A, companies are often valued based on LTM revenue (last twelve months), not annualized recurring revenue or even forward revenue. SEG tries to push acquirers to apply multiples to these higher revenue figures, but it’s atypical. Depending on how fast you’re growing, there could be a big difference in value between 5x LTM revenue and 5x ARR.

Private equity. In Q2 2020, private equity buyers represented half of buyers (~50%). They often pay higher premiums than strategics, so you shouldn’t only reach out to strategics when you go to sell. A banker like SEG can make sure you properly canvas the entire universe of buyers.

Below are a few more general rules of M&A.

Growth. In order to earn a premium multiple, strive for maintaining at least 40% year over year growth with at least 90% of that revenue coming from contracted recurring streams.

Profitability. If you’re growing under 40% per year or even slower, strive for a comfortably strong EBITDA margin (20% to 30%). If you’re not profitable, growth needs to be well in excess of 40% to offset, or you’ve got to be able to make a case that you could be profitable if you wanted to be, but you’re re-investing cash in sales and marketing burning cash in order to spike growth.

Qualitative Factors. Non-financial factors such as the age of the tech, strength of the team, and the uniqueness of the product all come into play. If your product is good enough, many acquirers will overlook major shortcomings on the financial side.

M&A is Unpredictable. M&A can take anywhere from 2 months to 2 years depending on what type of process is run (abbreviated versus full) and what the interest level is for your company. When an acquirer solicits you and you say ‘no’, that acquirer doesn’t just wait around for you to decide to sell. They either build your tech themselves or they acquire a competitor, even if that competitor isn’t as good as you. Once either of those two things happens, consider that acquirer gone in the future. We’ve seen this happen first hand when Yahoo tried to acquire one of our portfolio companies. We said ‘no’ believing we could get a higher price later. Then when we were ready to sell 2 years later, Yahoo was gone as a potential acquirer as they went out and bought some of our smaller competitors.

Hiring a great banker is critical to maximizing value in an M&A process, and banks like Software Equity Group are who you should look to.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada. Feel free to connect with Sammy Abdullah on LI.