Non-recurring revenue is ~20% of total SaaS rev

VC love recurring revenue and many VC won’t ascribe any value to non-recurring revenue streams. That said, do not forsake non-recurring revenue streams. If you do, you’re ignoring free financing and a way to make the product stickier. Non-recurring revenue streams like onboarding fees and installation fees are a fantastic source of cash, which means you won’t have to raise as much money to achieve your goals. Other non-recurring revenue streams such as ongoing services or support are great for staying in touch with the customer, which prevents churn and uncovers upsell opportunities.

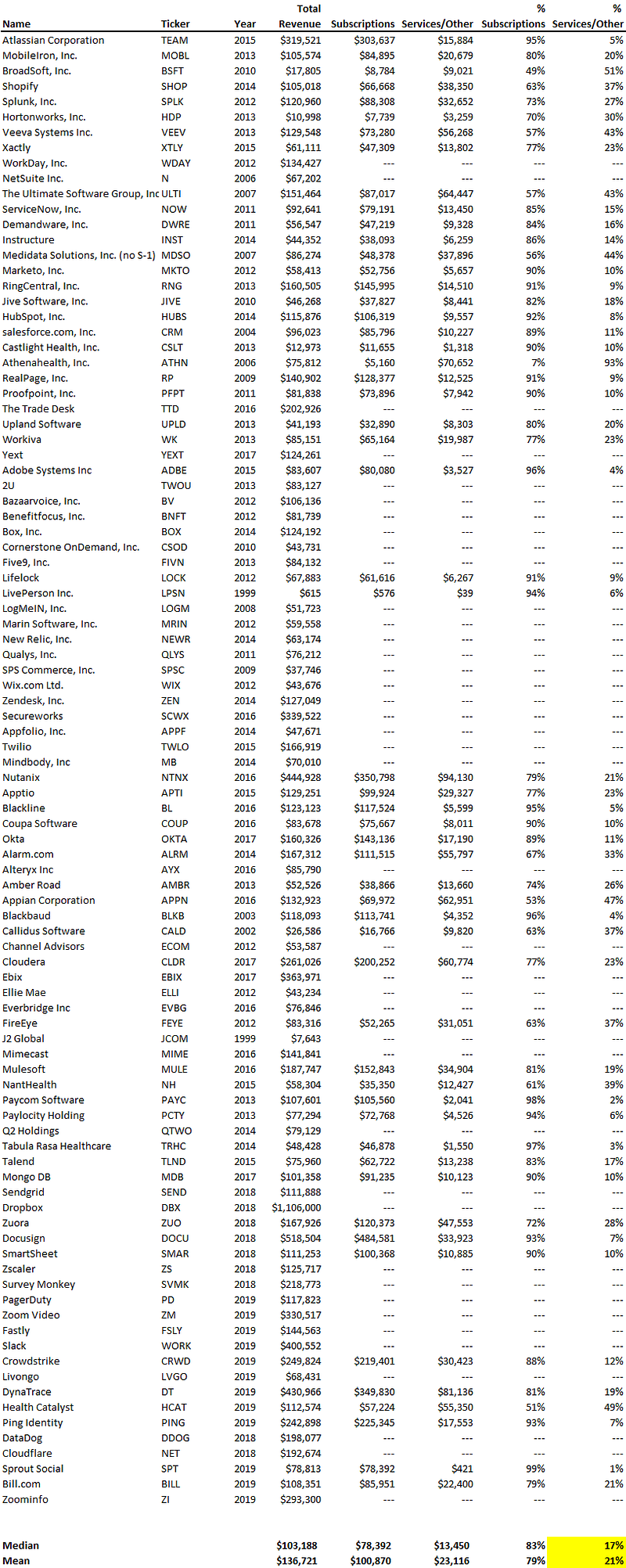

In order to see the revenue breakdown at exit/IPO, we looked at the revenue data at the time of IPO for SaaS companies. Of the 96 publicly traded SaaS businesses we monitor, 63 of them broke out their recurring SaaS revenue from other sources of revenue. We present the list below to show that some of the largest SaaS success stories derive significant revenue from non-subscriptions sources.

Of the 63 companies, on median and average, 83% and 79% of revenue is derived from subscriptions, which leaves a healthy minority of revenue represented by non-recurring streams (17% and 21%). Other revenue streams are diverse: Atlassian and Splunk derive a significant portion of revenue from maintenance, MobileIron derives a fair amount from perpetual licenses and support, and Shopify generates material revenue from merchant processing fees. Nearly half of Health Catalyst’s revenue is services, and I’d argue it’s one of the reasons they enjoy high retention.

If you’re generating revenue only from subscriptions, there is revenue you’re leaving behind which can serve as free cash financing and make your product stickier. Although VC may not like non-recurring revenue, it will help you build a real business similar to the public companies shown.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.