ACV is a dumb metric

There, I said it. Average Contract Value is (“ACV”) is a vanity metric that does not deserve focus. It is a byproduct of your business model, not a driver of it. It shouldn’t be put on a pedestal. Here is why:

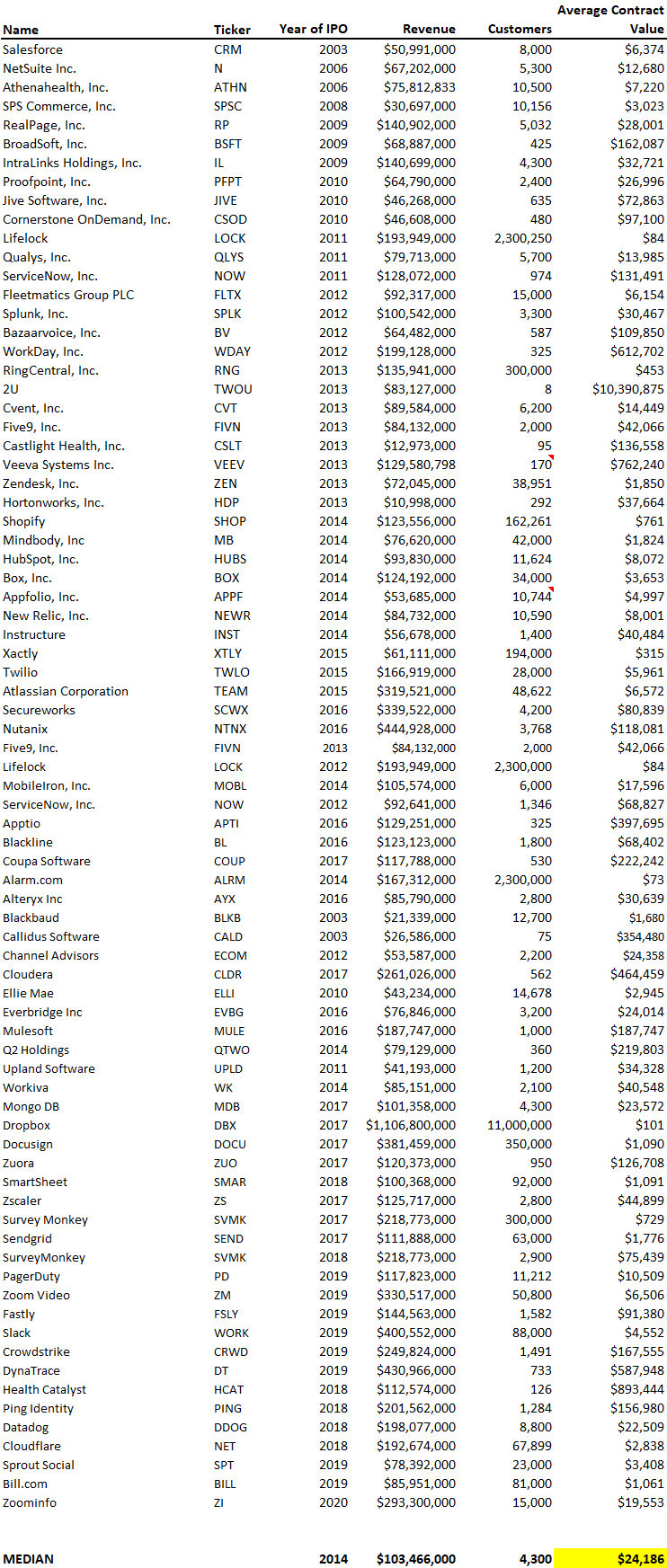

The world’s biggest and best software companies tend to have smaller ACV’s. Below is a data set of 78 publicly traded SaaS companies and their estimated ACV’s at exit/when they went public. To do the analysis, we looked at each Company’s financials before going public and compared their annual revenue to the number of customers at the end of the year. Upon going public/exiting, the median ACV was only $24,186. This makes sense as the universe of companies that can afford a lower ACV is much higher than those that can afford a $50,000+ ACV so by focusing on a lower ACV, you can grow into a bigger company and exit faster.

Increases in ACV aren’t free. Usually in order to increase ACV, it means some other metric of importance gets worse, for instance the sales cycle gets longer, the close ratio comes down, and the number of leads needed to complete a sale increase. In order to achieve higher ACV’s, you have to focus on larger clients which inevitably means more layers of management for approval, more time required to identify the decision maker, more layers of bureaucracy to fight through, etc.

ACV is a metric that should be monitored, but don’t change the way you sell in order to artificially increase it. While metrics like ACV are valuable, the real metrics you should be focused on are revenue, cash flow, retention, and growth. ACV is an effect of these metrics, not a cause.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . Connect on LI as well. We like to lead or follow. We invest $1mm in growth rounds, inside rounds, small rounds, ‘tweeners’, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.