The most important metric in software

Dollar retention is the most important measure in SaaS. There are two ways to measure it: gross dollar retention and net dollar retention. Gross dollar retention looks at how much of the customer base you’ve kept year over year without including upgrades. Formulaicly, it’s ARR — downgrades — churn all divided by beginning ARR and as such it’s always below 100%. Net dollar retention is similar, but it includes upgrades. Formulaicly, it’s ARR + upgrades — downgrades — churn all divided by beginning ARR. A healthy SaaS business has net dollar retention over 100% because upgrades in the customer base are outpacing churn and downgrades.

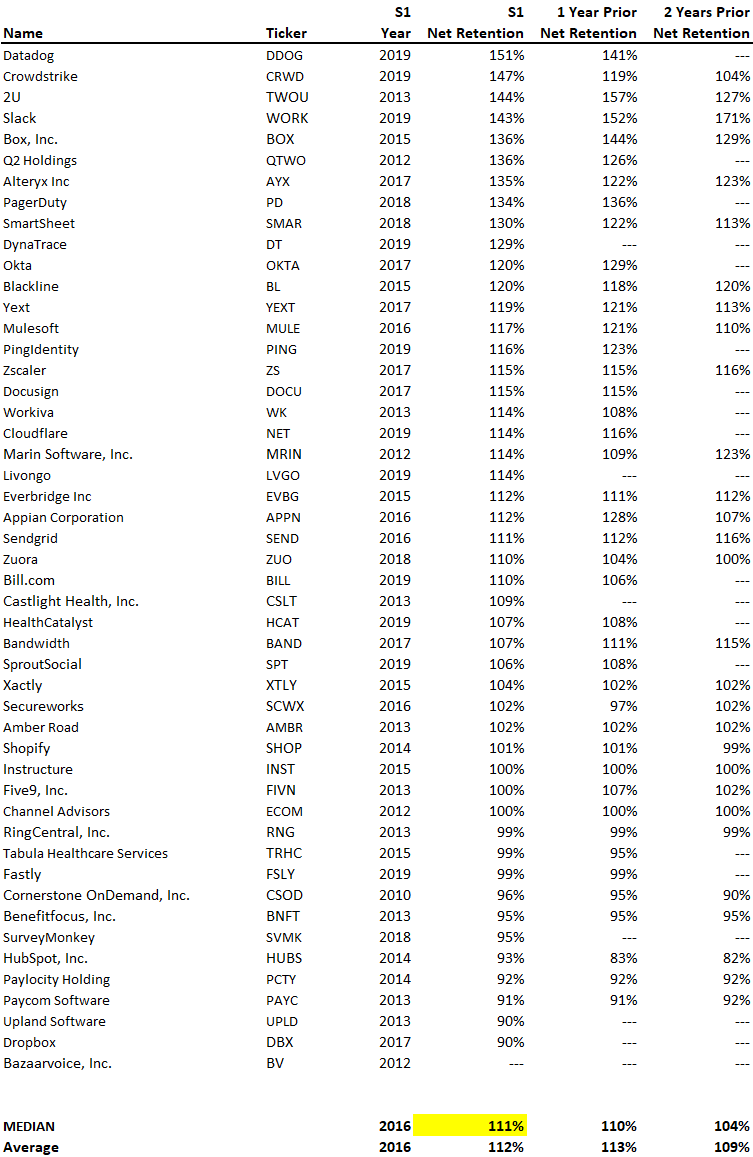

We found 49 SaaS companies which disclosed their net dollar retention at IPO. The data is below and shows on median, the net dollar retention was 111% while the top performers are well above 120% (top 5 averaged 144%).

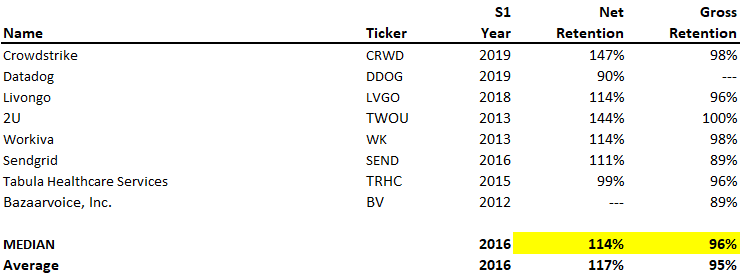

While 49 companies disclose net dollar retention, only 8 of those disclosed gross dollar retention. That data is presented below and as you can see, median gross dollar retention is 96%, which is extraordinary.

A few observations stand out.

Focus on the customers that matter. Both measures of dollar retention are important, but to us, the more important measure is net dollar retention. You shouldnt care so much about losing customers that weren’t a good fit (every SaaS company is guilty of signing up customers they shouldn’t have), whereas you should obsess over customers you lost that are a good fit. So long as your target customer base is upgrading more than they’re downgrading and churning, you’ve got a great SaaS business.

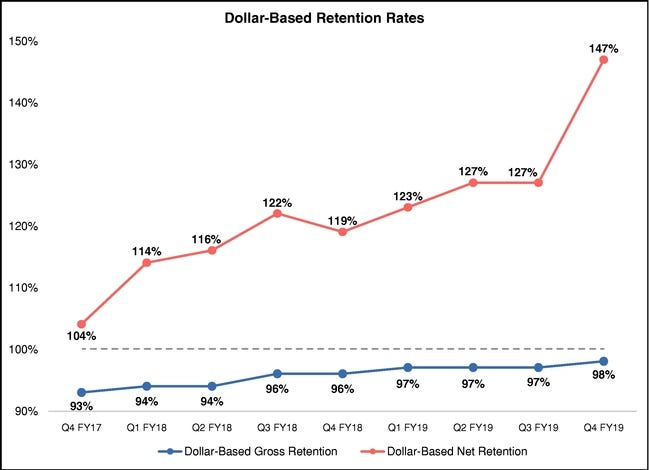

Creating real value means driving upgrades. The difference between 90% gross dollar retention and 95% gross dollar retention is meaningful, but not huge. However, the difference between 99% net dollar retention and 147% net dollar retention is massive. The lesson is keeping customers is important, but not as important as keeping and upgrading your target customers. One of the biggest drivers of value in SaaS is showing that you’re not only keeping the customer base, but they’re also a source of new revenue driving growth in the business. Crowdstrike’s chart of gross and net dollar retention shows the additional value derived from upselling ($1.00 of ARR going to $1.47) versus simply improving gross retention (93 cents of ARR going to 98 cents).

Gross dollar retention needs to be above 89%. Of the 6 publicly traded companies that disclosed their gross dollar retention at IPO, the lowest figure was 89%. While net dollar retention should be your real focus, try not to let gross dollar retention fall below 89%. Obviously, the higher gross dollar retention is, the higher net dollar retention will be.

Net dollar retention needs to be above 100%. SaaS is a beautiful business model when net dollar retention is 100% or higher. It means you’re effectively keeping the customer for life. The median net dollar retention of the 49 companies above is 111% so that should be your target, but generally speaking so long as you’re over 100%, you’re in good company. As you can see, 11 of the 49 companies above had net dollar retention below 100% and still managed to go public.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . You can also connect with me on LI. We invest $1mm to $1.5mm in growth rounds, inside rounds, and other ‘special situations’ all over the US & Canada.