The economics of saas

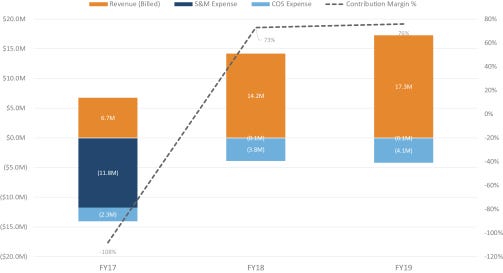

Bill.com recently went public. Their software automates complex back-office financial operations for small and midsize businesses (SMBs). One of the charts in their prospectus shows the revenue growth and contribution margin of customers acquired in 2017; it’s a very nice illustration of the first three years of a SaaS customer in a healthy SaaS business. The chart is below.

In the first year, you lose money. Generally speaking, the first year of any customer in a SaaS business is an unprofitable one. That’s because the sales & marketing expense to acquire the customer is incurred in year 1. As you can see for Bill.com, for fiscal 2017, the 2017 Cohort represented $6.7 million in revenue billed to these customers, $11.8 million in sales and marketing costs to acquire these customers, and $2.3 million of cost of sales representing a computed contribution margin of -108%.

In the 2nd year, you start becoming profitable. Since you never incur sales & marketing expense again to acquire the customer, the only cost in any SaaS business is just the “cost of sales”. In fiscal 2018 and 2019, the 2017 Cohort represented $14.2 million and $17.3 million, respectively, in revenue billed to these customers and $3.9 million and $4.2 million, respectively, in estimated costs related to retaining and expanding these customers, representing a computed contribution margin of 73% and 76%, respectively.

The revenue grew. Note that revenue in year 1 was only $6.7mm. In years 2 and 3, it was $14mm and $17mm respectively, meaning the cohort grew. Indeed, good SaaS businesses have cohorts that grow over time, as upgrades in the customer base outpace downgrades and churn.

Payback is fast. According to Bill.com, “for customers acquired during fiscal 2018, the average payback period was approximately five quarters.” Good SaaS businesses recover the cost of acquiring the customer within 1.5 years.

Bill.com’s customer cohort is a nice example of what a good SaaS business will experience: i) you lose money on the customer in year 1; ii) in year 2 the customer becomes very profitable and you recover the cost of acquiring the customer; iii) over time, your customers buy more product from you rather than less. Maintain these same attributes in your own SaaS business and you’ll be on your way to joining Bill.com as a public company.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.