SaaS multiples are holding strong

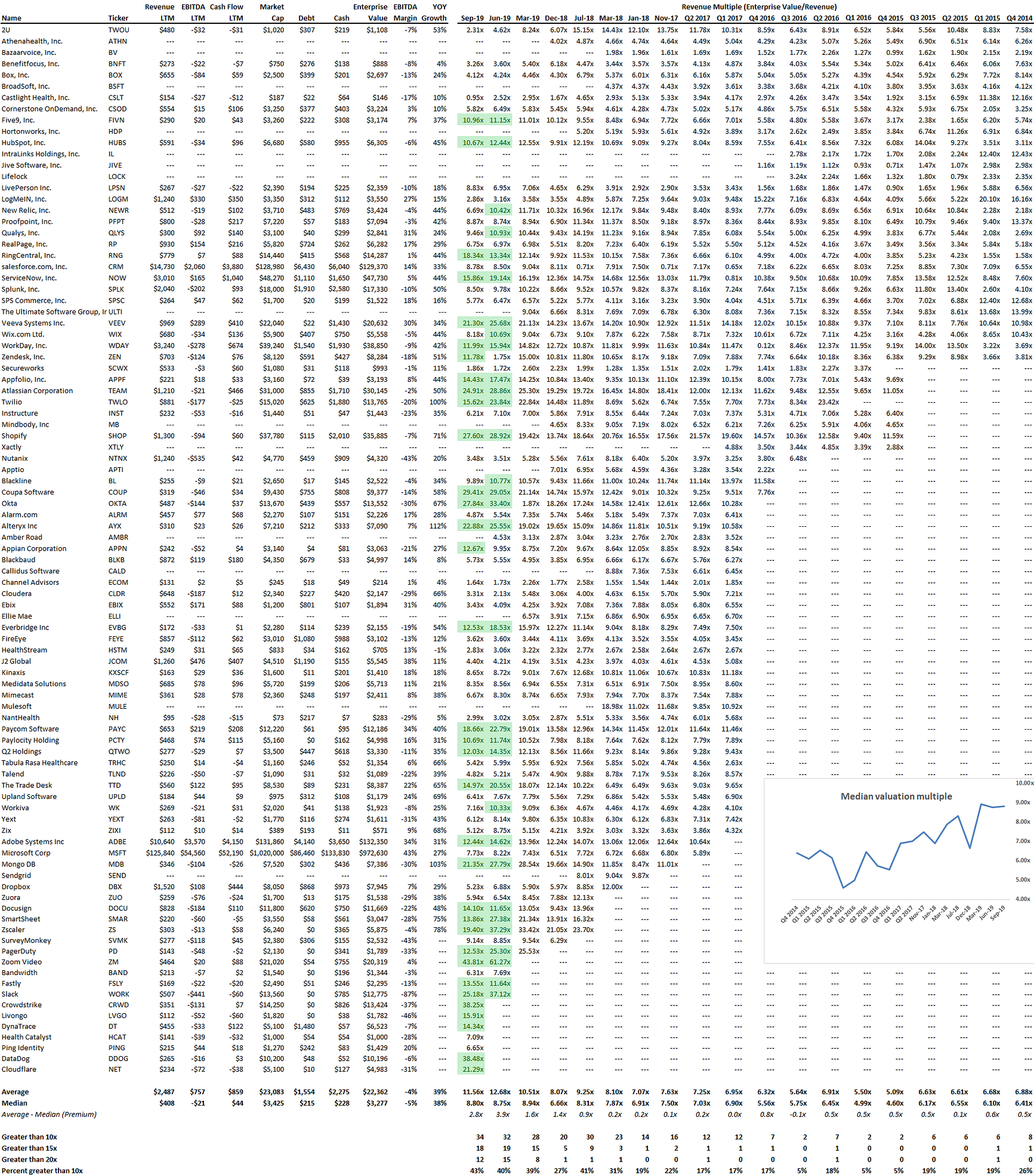

SaaS multiples are higher than they’ve been since we’ve tracked the data (Q4 2014): of the 79 SaaS companies we follow, the average public SaaS business is trading at 11.6x revenue while the median is 8.8x. Interestingly, the gap between the average and median continues to be large (2.8x), meaning more attractive SaaS companies are being rewarded with big premiums. Also of note, 43% of companies are trading at 10x revenue or greater, which is the highest the figure has ever been. It’s a great time to be a SaaS company. The data is below.

Negative EBITDA, positive cash flow. The median SaaS business had trailing twelve month revenue of $408mm, EBITDA of -$21mm, but positive operating cash flow of $44mm thanks to up-front collections on annual contracts. Indeed so long as you’re growing (the median annual growth rate is a strong 38%), investors will overlook negative EBITDA especially if the business is cash flow positive after working capital changes.

The trend is still on. The chart in the picture shows median revenue multiples we’ve collected since Q4 2014. During that period, the median SaaS multiple has ranged from 4.6x to 8.9x with an average of 6.9x.

SaaS margins are still terrible. Investors and founders love saying “SaaS margins are great.” They’re not. They’re horrible. The median EBITDA margin for the companies above was -5% and the average was -4%. Fixed costs for SaaS are terribly high and worse yet those fixed costs are mostly people, meaning the only way to materially cut costs is layoffs. If you’ve ever fired someone, you know cutting costs by cutting people is not easy and hurts the culture and morale of remaining members.

Premium gets a premium. Premium SaaS businesses trade at premium multiples. In the data set, 34 companies trade at greater than 10x revenue, 18 trade at greater than 15x, and 12 trade at greater than 20x.

Growth is strong. The median of 38% is strong given the size of these companies ($408mm of median revenue).

SaaS businesses are healthy. There is almost no debt on these businesses as banks don’t like ‘asset-lite’ businesses like software. Additionally, these companies have $228mm of cash on the balance sheet on median, plenty relative to annual burn (recall EBITDA is -$21mm). The number of years of cash on the balance sheet is less important given that these businesses are generally cash flow positive (median of $44mm; only 19 out of the 79 companies have negative cash flow. Note that 46 out of the 79 have negative EBITDA, but again that’s acceptable so long as the growth is there and cash flow overall is positive.

Recent IPO’s are killing it. Some of the latest IPO’s are trading at unreal multiples: Cloudflare is at 21x, Datadog is 38x, Crowdstrike is 38x, Slack is 25x, and Zoom Video is a whopping 43x. It shows that now is a great time to come to market whether you’re raising money or selling the business. Some recent IPO’s are trading at more reasonable multiples (HealthCatalyst is at 7.0x and Ping is at 6.7x), so the disparity in valuation for premium SaaS versus just good SaaS is very wide.

So what’s this data mean for a fast growing private SaaS business? Public multiples and trends guide what’s happening in the private markets: i) as compensation for illiquidity, size, and lack of profitability, prudent investors will look to invest in your private SaaS business somewhere below the median unless your growth rate is demonstrably higher than 38% YOY; ii) financing will continue to come from equity, less so from debt, although we’ve seen lenders like Lighter Capital get more creative; iii) and burning cash is still acceptable on an EBITDA basis, so long as free cash flow is positive or moving in the right direction.

Visit us at blossomstreetventures.com or email [email protected] , especially if you have Series A or B opportunities. Founder emails are always welcome.