Protecting founders from dilution

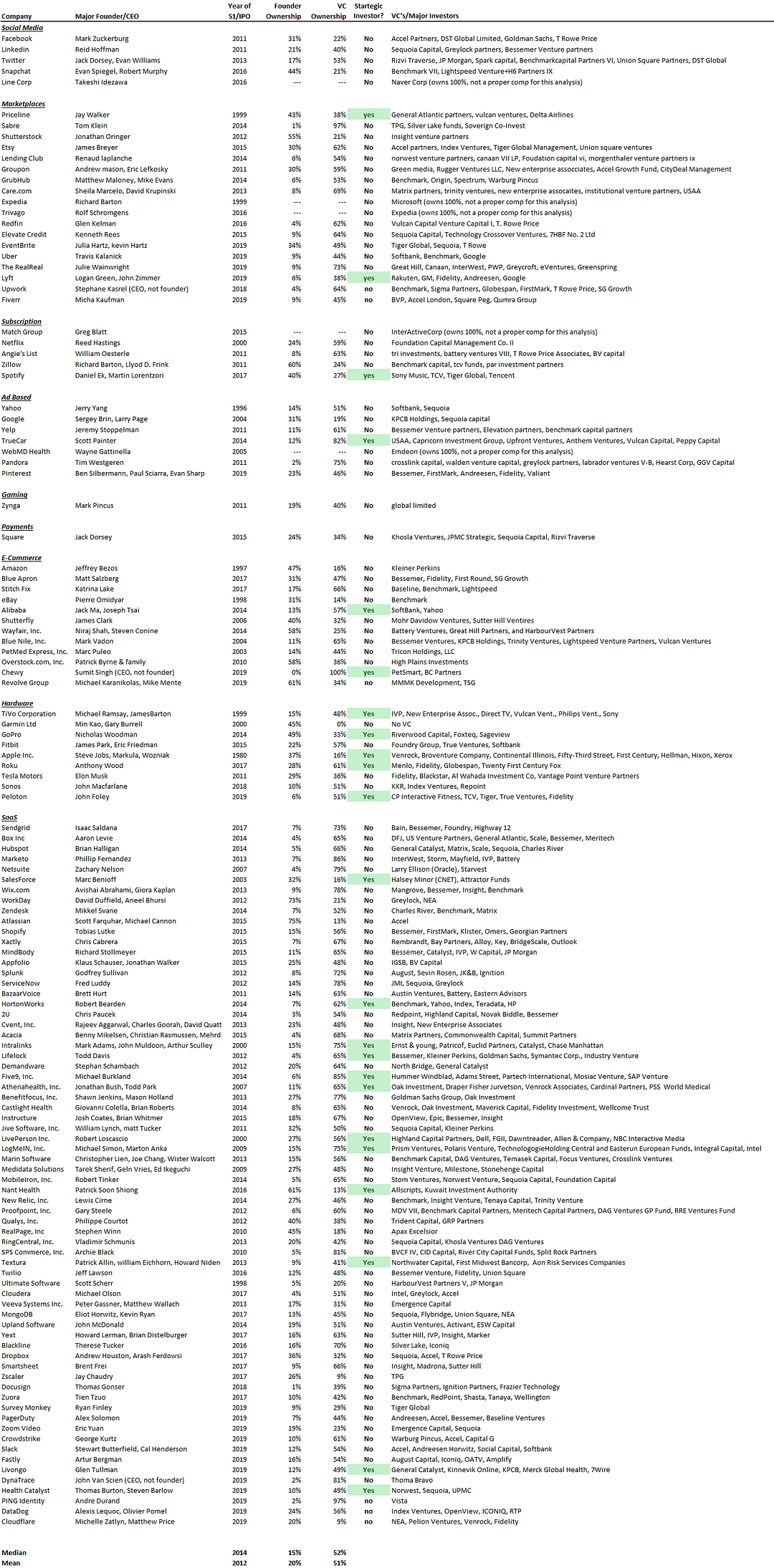

Valuation is more important than capital raised to preserve your ownership. To determine this, we looked at founder ownership relative to equity raised for 110 publicly traded tech companies. Our goal was to see if founders that raised less capital owned more equity upon exit, and vice versa, founders that raised more capital owned less equity upon exit. The data surprised us as there is no discernable relationship between founder ownership and capital raised. We thought the more equity raised, the lower founder ownership would be, but that didn’t turn out to be the case. We suspect this means the valuation at which you raise has a greater impact on your ownership than the amount of capital raised.

In order to determine a relationship, we look at correlation. Recall that if the correlation was -1, it would mean definitively that the more equity raised, the lower founder ownership would be. Alternatively a correlation of 0 would mean there is no relationship at all between capital raised and founder equity, and a correlation closer to 1 would mean the more equity raised, the higher a founder’s ownership would be (very perverse). The data is below.

Software shows no correlation. Software is the only category where we really have a lot of companies to look at such that we can isolate that category. In the software category, you can see the correlation is -.01 meaning there is no discernable relationship between capital raised and founder ownership.

Hardware and ecommerce show negative correlation. Hardware and ecommerce are the only other categories where we believe there are enough companies to look at each segment in isolation. Hardware had a correlation of -0.61 and ecommerce was -0.44. This is more in line with what we expected to see. In other words, the more you raise in those categories, the less founders own.

No correlation generally. For the entire set, the correlation is -0.07, when we exclude software it’s -0.19, and when we look at just software it’s -0.01.

So how can there be no relationship between founder equity and capital raised? Does this mean you should raise as much money as possible? No. Looking at the data in a silo is somewhat misleading: if you raise money, you’re getting diluted. That’s a fact. But, valuation matters so if you can raise at very high valuations, your equity is much more likely to be preserved whereas if you’re getting low valuations, large capital raises will eat materially into founder equity.

The data leads us to conclude that valuation is more important than total capital raised when determining the impact of capital raises on founder ownership.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.